Captive Insurance

In 1810, Connecticut founded its first US insurance company in Hartford and since then the city and state have earned their reputation as the Insurance Capital of the World. Today, Connecticut has 46 captives, with 11 of these being owned by Fortune 500 companies. Approximately 1,500 insurance companies write over $40 billion in premiums in Connecticut and are available to captives for fronting, reinsuring and professional services.

A Thriving Industry

“As the insurance capital of the world, Connecticut is the only state with a great location, modern captive laws, low fees, and responsive and experienced regulators and service providers for the captive insurance industry to grow.” - Insurance Department Commissioner Andrew N. Mais

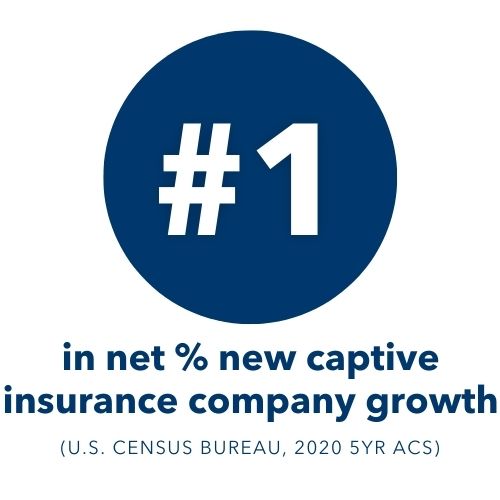

Connecticut is the number one state for insurance professionals and maintains the highest concentration of insurance employees and actuaries in the U.S. Two centuries of insurance experience, plus a strong work ethic and ambitious plans for further innovation, are helping to make Connecticut a superhero among captive domiciles.

Excellence in Captive Insurance

Legislative & Regulatory Support

The commitment of Connecticut’s state leaders, regulators, and state legislature to support and foster the growth of captives is second to none. We know that captives bring more jobs, capital, and business activities to the state. Connecticut’s captive regulators are capable and flexible with modern captive law, and we plan to fine-tune state captive statues to meet the needs of captive owners.

Connecticut’s law allows all types of captives, and the insurance commissioner has the appropriate level of discretion to regulate captives according to their unique risk profiles. The Insurance Department has modernized the captive application process and shortened the turnaround time for all requests. Connecticut now makes quick decisions and processes requests efficiently using a principled and risk-based regulatory approach.

A new bill, which will become effective on October 1, 2023, introduces several key changes to Connecticut's captive insurance laws, including: revolutionizing risk management by allowing captives to accept and transfer risks through parametric contracts; providing greater flexibility to sponsored captive protected cells enabling them to establish separate accounts to effectively address businesses’ specific insurance needs; and providing benefits for owners of dormant captives. This legislation builds upon previous legislative achievements from 2022, when the state implemented many other pro-captive laws, providing innovative solutions and increased flexibility for captives. These continued efforts have further positioned Connecticut as a leading domicile for captive insurance. For more details on this new law click here.

Take Your Captive to Connecticut

“Key to Connecticut’s captive insurance excellence is the fact that the state has everything that captives need to thrive.” - Fenhua Liu, Assistant Deputy Commissioner, Captive Insurance Division, Connecticut Insurance Department.

For more information visit the Captive Insurance Division of Connecticut’s Insurance Department or the Connecticut Captive Insurance Assocaition.

Contact:

Fenhua Liu

Assistant Deputy Commissioner & Director

Captive Insurance Division | Connecticut Insurance Department

(860) 256-7925 | Fenhua.Liu@ct.gov